Because of Jeff's personal experience with this medical innovation, he thinks it can alter the world: "it's an amazing new pattern in medication driven by innovation that identified cancer. And offered me a battling chance to beat it super early prior to it turned into a possibly deadly problem." jeff brown investor Jeff does not just suggest buying this business to capitalize on this trend.

: "But there's more to this innovation than simply conserving my life. By subscribing to The Near Future Report today, you can discover how this innovation works, what it does, and why Jeff thinks it will alter the world of medication.

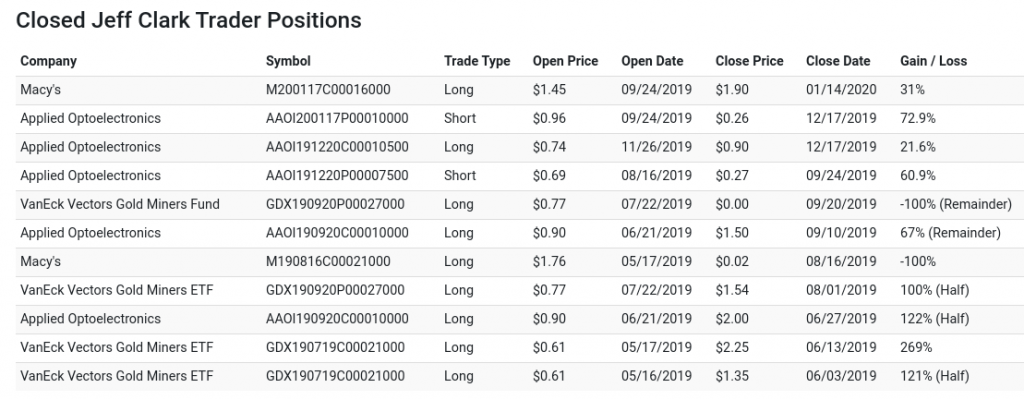

"There's Biolife Sciences, which rose as high as 41,800% in less than a year, A little, $1,000 stake could have revived as much as $418,000." The sales page is filled with similar gains. Jeff Brown utilizes Mirati Therapies as an example, which rose 8,481% in under two years. Other gains included on The Future Report's sales page consist of: Jeff Brown takes care to explain that previous revenues do not guarantee future outcomes.

He does not suggest allocating a considerable part of your portfolio to these stocks. Nevertheless, Jeff also claims he has Click for more info actually "checked out providers and done his own research study on future revenues" to validate his suggestions. Based on that analysis, Jeff is confident that a few of his biotech stock picks will rise considerably in the near future.

2 Trillion Market that Could Conserve Millions of Lives? Jeff, like lots of investors, thinks biotech will be one of the most popular tech patterns over the coming years. Biotech is no secret.

Jeff discusses precision medication as one example: "the biotech market is anticipated to grow 86% over the next couple of years. That is impressive. However listen to this, The accuracy medication market is anticipated to grow 152% throughout that very same time" Accuracy medication is an emerging area of biotech that utilizes precise biological information to compute disease danger.